Helium (HNT) has halved in price in the last month despite recovering around 20% from Saturday’s low. The real damage occurred after the price fell below $39.00. While Bitcoin’s collapse over the weekend was certainly a factor, the damage had already been done long before this. On November 11th, HNT surged to an all-time high of $59.277, putting it far into overbought territory and increasing the likelihood of a severe decline. HNT returned 30% in a week, leading us to wonder if another 30% drop was imminent. Despite this, there may be more downside room in the 34% decline that came after our report was released.

HNT Price Forecast

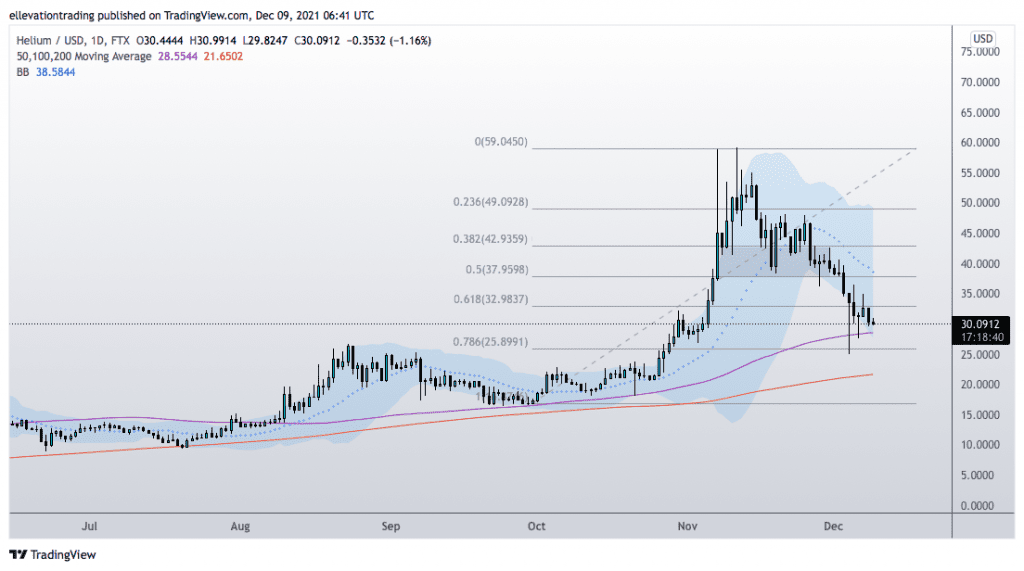

In the daily chart of Helium, we can see the price bounced off of the 100-day moving average at $28.550. This rally, however, does not appear to be taking hold.

Another landslide might occur if the price closes below the 100-DMA. Therefore, it should extend towards the 200-DMA at $21.649, which corresponds to a price of around 30% below the current price.

Helium needs to close above its October 28th (former all-time) high of $32.287 to regain bullish momentum. The bearish view is therefore invalidated if Helium closes over that level.

Daily Price Chart: HNT

Original Article can be found at //www.investingcube.com/helium-price-downside-target-hit-but-risk-remains-high-cryptocurrencies-helium/